Tax laptop depreciation calculator

Bonus depreciation allows you to write off 100 of the cost of anything you purchase in the first year. Tax filing season always begins in September after the tax year finishes 2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund.

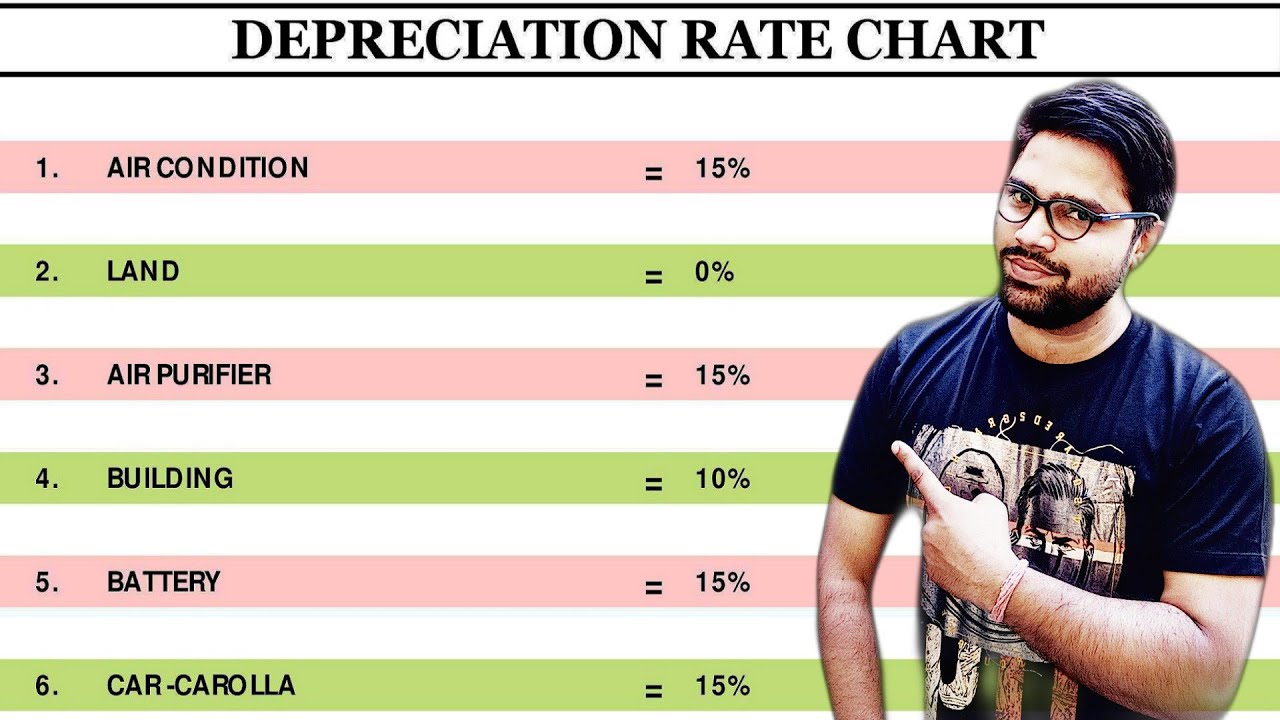

Dep Rate Chart Depreciation Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Youtube

Again remember this is for the business-use portion of your computer Thats it really.

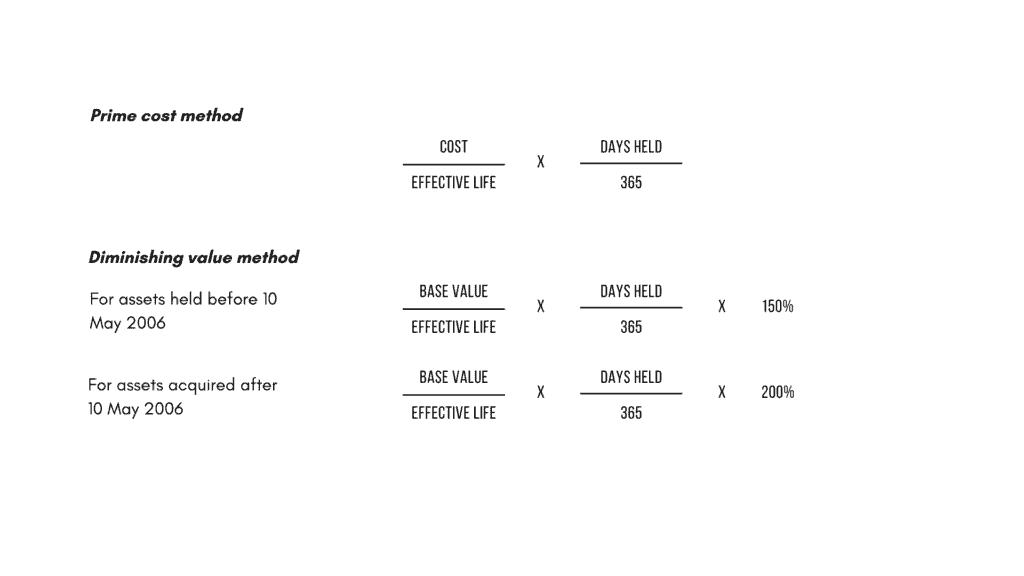

. Jokes aside bonus. Self-employed people end up having to pay both sides of FICA taxes at 153 of total income. 2 x Single-line depreciation rate x Book value.

Depreciation Discount Dual Power SolarBattery. 150 Steps Check Tax Keys Digit. This investment can range from a single laptop to a fleet of trucks to an entire manufacturing facility or an apartment building for rent.

Unlimited access to TurboTax Live tax experts refers to an unlimited quantity. If you use your laptop 100 for work over the life of its depreciation 2-3 years based on ato website you will get that 600 back in tax deductions plus whatever other expenses you claim. For the 2021 tax year that rate is.

Passive Income Loss Rule. But the Tax Cuts and Jobs Act of 2017 ended up leaving landlords and their rental income free from any FICA taxes. You can deduct the actual expenses of operating the vehicle including gasoline oil insurance car registration repairs maintenance and depreciation or lease payments.

Period - The estimated useful life span or life expectancy of an asset. 12 Digits Display Power Sources. Or you can use the standard IRS mileage deduction.

Below is the explanation of the values that are required to add to the calculator for calculation. The cost is less than 300. Furthermore the objectives of financial reporting and tax depreciation are different.

Buy Calculator at best price in Bangladesh. 50 bonus first year depreciation can be elected over the 100 expensing for the first tax year ending after September 27 2017. Where the cost is more than 300 then the depreciation formula must be used to calculate the percentage tax deductible amount.

But the result that you get is in the Text Format. Generally tax methods and lives take advantage of rules that. Sum-of-the-years-digits depreciation What it is.

Bonus depreciation is automatic meaning you dont have to check any boxes or submit elections to get it. Latest Casio ClassWiz ES PLUS MS Series Scientific Calculator available at Star Tech Shop. Tips for fixed asset capitalization rules and policy.

If I salary package the laptop I can claim two levels of tax deduction. Sum-of-the-years-digits SYD depreciation is another method that lets you depreciate more of an assets cost in the early years of its useful life and less in the. However if your business has already had a tax loss for a given year you wont benefit from an additional tax deduction.

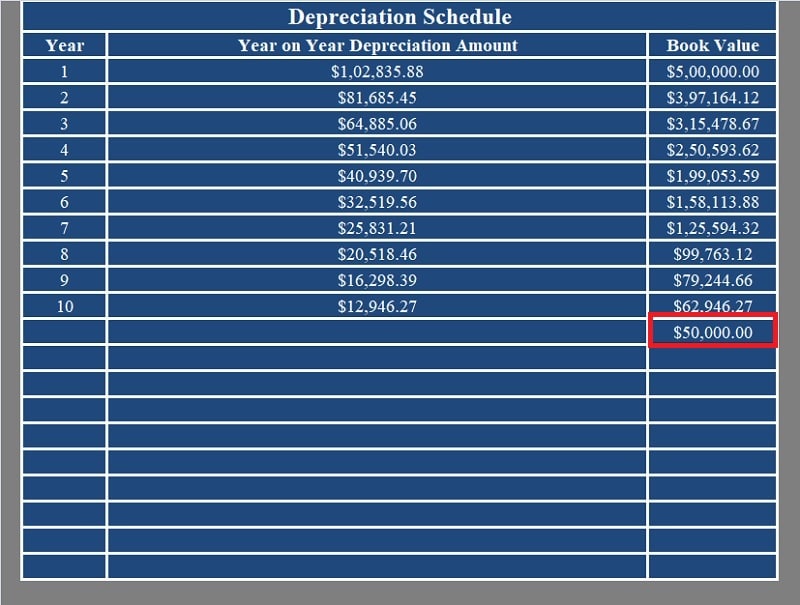

19 of CGST Act Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax. Estimate your tax refund and where you stand Get started. To get a better sense of how this type of depreciation works you can play around with this double-declining calculator.

Laptop or the TurboTax mobile app. If you havent done so already consider using a tax calculator to make sure everything is accurate. So you cannot directly use the result in.

Final value residual value - The expected final market value after the useful life of the asset. Solar. There are 4 pre-conditions on the under-300 full claim allowance.

All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Depreciation on laptop as per companies act 2013 is 6316 under WDV. Asset value - The original value of the asset for which you are calculating depreciation.

Deduction on the 3000 and another deduction for work-related expenses. You may use the depreciation calculator to calculate the depreciation amount. The INR function converts a number to the Indian Style Comma formatted currency as you can see in the snapshotThe commas are placed in the right places separating lakhs and crores.

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Asset Depreciation Getting The Most Back On Your Tax Return

Download Depreciation Calculator Excel Template Exceldatapro

What Is The Highest Rate Of Depreciation Under Income Tax And For What Items Quora

Download Depreciation Calculator Excel Template Exceldatapro

Top 3 Online Depreciation Calculator To Calculate Depreciation

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Working From Home During Covid 19 Tax Deductions Guided Investor

How To Calculate Depreciation

Straight Line Depreciation Calculator For Determining Asset Value

Depreciation Formula Calculate Depreciation Expense